The Pattonville Board of Education on Sept. 26 voted to approve the district tax rate for the 2023-2024 school year. School boards in St. Louis County set tax rates each year for four classes of property within school district boundaries: residential, commercial, personal and agricultural. The rates for all four property classes, as approved by the board, are: residential: $3.8590; agricultural: $5.4006; commercial: $4.6767; and personal property: $5.4006.

As the assessed value of each class of property changes, the district is limited to the lesser of three factors by Missouri law, to the amount of revenue it can receive. Those factors and their rates in Pattonville for 2023 are:

- increase in assessed valuation, at 17% for Pattonville;

- the increase in Consumer Price Index (CPI), at 6.5% for Pattonville; or

- no more than 5% if the other rates are higher.

Because the increase in both assessed valuation and the CPI were all higher than 5%, the allowable revenue increase can be no more than 5%, resulting in approximately $955,800 additional operating revenue for the 2023-2024 school year.

The assessed value of residential property increased by 20.94%, commercial increased by 22.43% and personal property increased 5.50%. The overall assessed valuation increase for all property in the district, excluding new construction, was 17%.

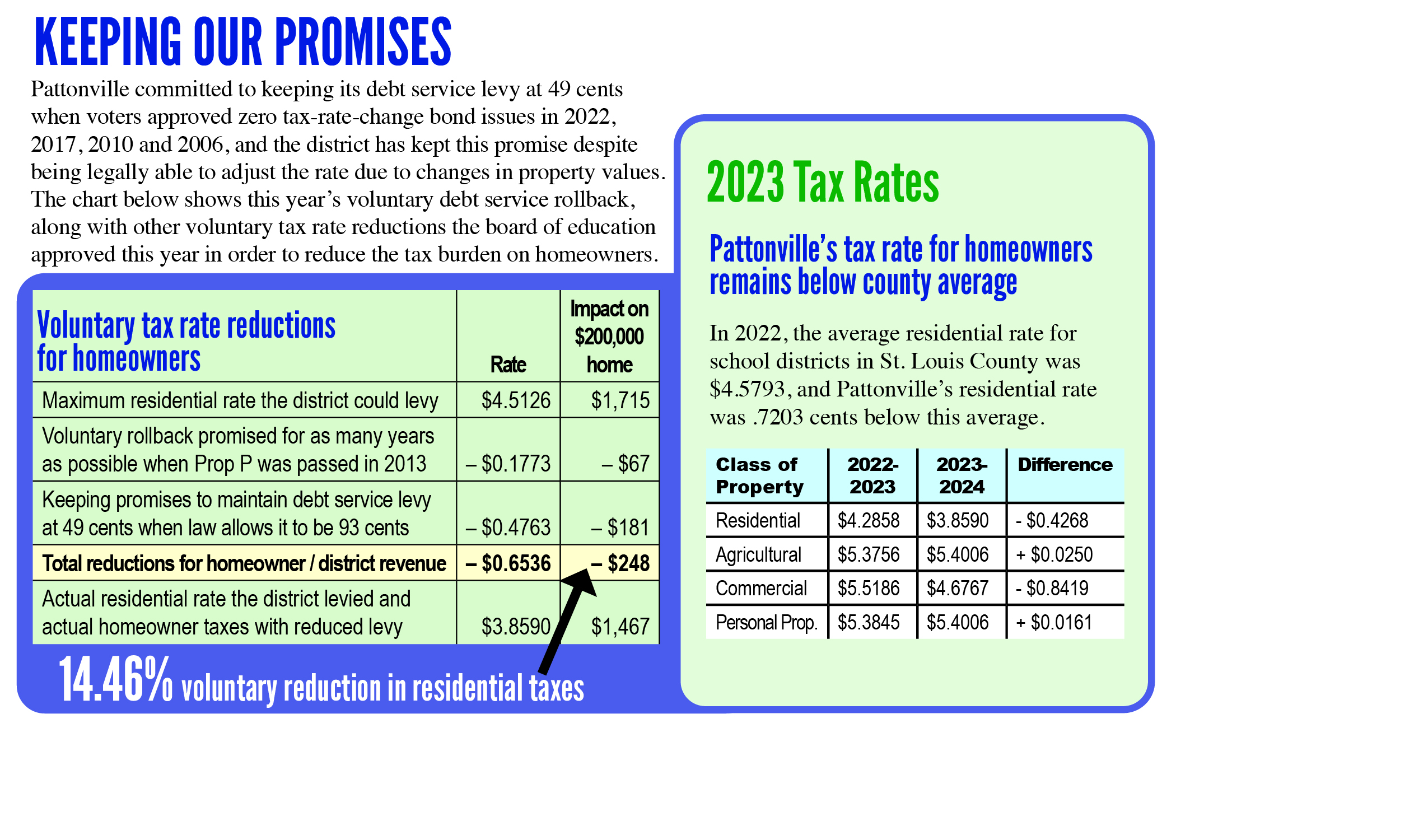

Also important to note is the fact that Pattonville’s residential rate will be lower than the rates for agricultural, commercial and personal property, as promised to voters when they approved the Proposition P tax rate increase in 2013. At the time of the election, the district promised to limit the residential tax rate increase for as many years as possible. Proposition P allowed the district to levy up to 99 cents, but the district has kept its commitment during the past 10 years to maintain a lower residential tax rate. As a result, we’ve rolled back our residential rate $0.1773 for the 2023-2024 school year.

Additionally, Pattonville continues to take a voluntary rollback to its debt service tax rate in order to lessen the tax burden on homeowners. The district’s debt service tax rate, which is part of the district’s overall tax levy, remains unchanged at 49 cents per $100 of assessed valuation, as promised to voters when they approved zero tax-rate-change bond issues in 2022, 2017, 2010 and 2006. Under the state’s formula for calculating tax rates and the district’s taxing capacity, the district could have levied $0.4763 cents more in its debt service tax rate. The total tax rate, including debt service, approved for residential properties is $3.8590 per $100 of assessed valuation. The overall impact of voluntary rollbacks on a $200,000 home in the district equates to a 14.46% reduction in homeowner tax bills (see chart below).

Approximately 83% of Pattonville’s revenue comes from local sources, which include taxes paid on property in the district. These taxes are based on the assessed value of the property, as determined by the St. Louis County assessor’s office. Pattonville will continue to monitor district revenues and expenditures to ensure the district remains fiscally responsible.

Pattonville is also monitoring the possible impact of Senate Bill 190, which allows counties in Missouri to provide a tax credit to seniors who own their home as their primary residence and who are eligible for Social Security benefits. Qualifying seniors would be exempt from property tax increases and their taxes would be frozen based on a credit set by the county collector. At this time, St. Louis County has not voted to provide this tax credit. The Hancock Amendment allows taxing districts to adjust their tax rate for lost revenue. However, there is no provision in SB 190 for the recovery of lost revenue. As such, it is impossible to forecast the potential decrease in revenue if St. Louis County was to approve the tax credit. Additionally, reduced revenues and the freezing of a portion of assessed values would be viewed negatively by credit rating agencies and could impact the district’s credit rating, which would increase the district’s overall cost of borrowing.